Apr 23, 2024

Blog Life Sciences Advancements in Insulin Drug Delivery: A Focus on Syringes and Vials

Insulin is a crucial lifeline for millions of people worldwide who manage diabetes. Insulin delivery systems are essential for the care and management of diabetes patients. BCC Research has classified these systems into four categories: syringes, insulin pens, insulin pumps, and smart pens. Our latest report on insulin drug and delivery technologies shows that traditional syringes and insulin pumps are being replaced by reusable and disposable insulin pens. This is because insulin pens provide greater dosage accuracy, ease of use, and portability.

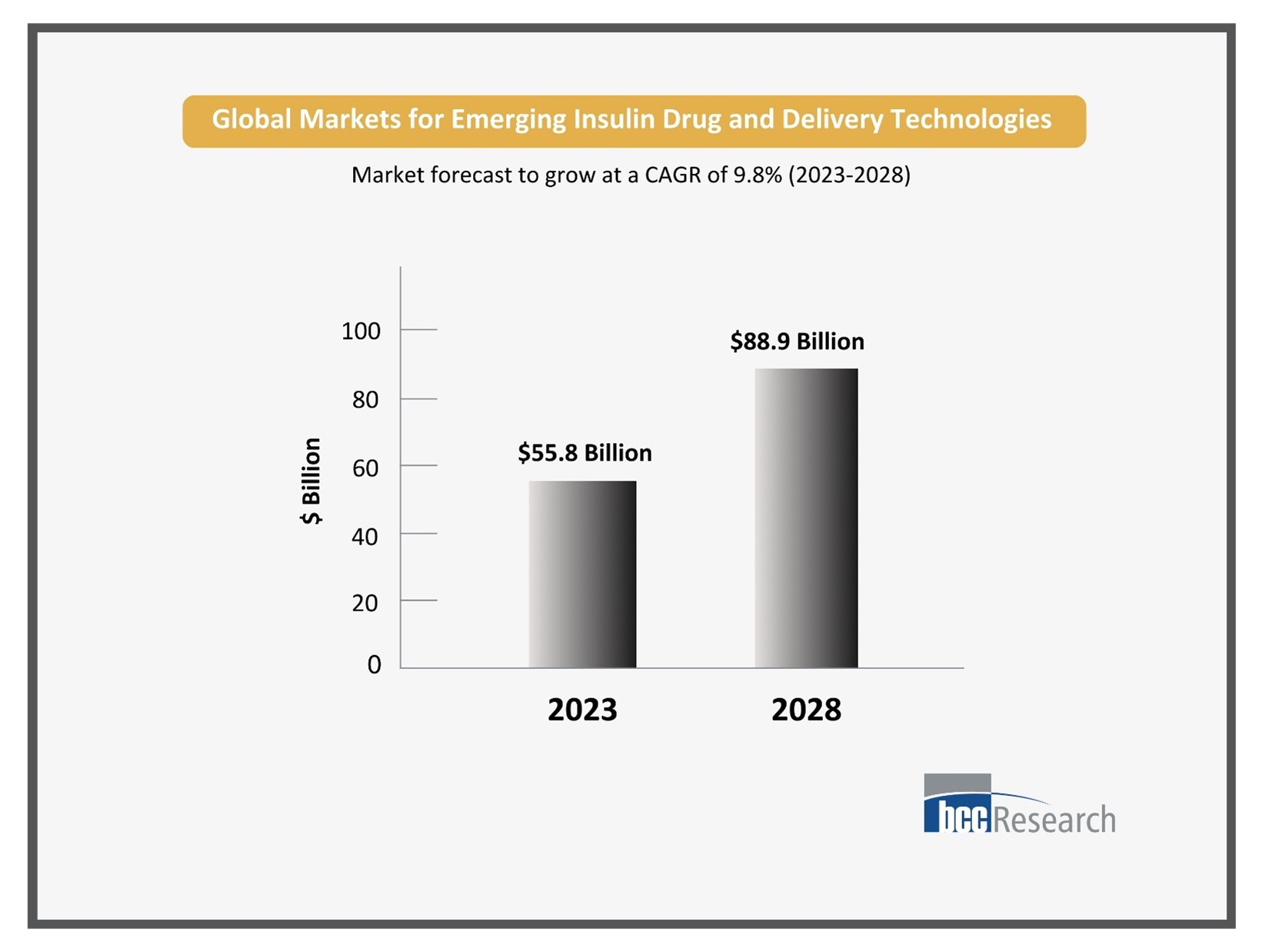

The global market for emerging insulin drug and delivery technologies is expected to grow at a compound annual growth rate (CAGR) of 9.8% to reach over $88.9 billion by the end of 2028. BCC analysts predict a strong future for insulin drug delivery systems in the adoption and development of smart devices, as discussed in our latest report: Global Markets for Emerging Insulin Drug and Delivery Technologies.

The global market for emerging insulin drug delivery devices is expected to grow from $55.8 billion in 2023 and projected to reach $88.9 billion by the end of 2028, at a compound annual growth rate (CAGR) of 9.8% from 2023 through 2028.

Syringes and vials have been the go-to tools for insulin therapy for a long time, as they provide a straightforward and effective way of delivering insulin to the body. Even though new methods of insulin delivery have been developed, many people with diabetes still depend on syringes and vials for their insulin needs. These tools are widely used by patients all over the world because they are familiar, affordable, and easy to access.

An insulin pen is a device that looks like a marker pen. It's used to inject insulin into the fatty tissue via a thin needle. It's preferred by travelers over syringes because it integrates the medication and delivery system, making it more convenient to use. To use an insulin pen, you twist or snap on a new needle, dial the required dose, inject the insulin, and then discard the used needle into a safe container.

In the field of diabetes management, there are several leading players who drive innovation in insulin delivery devices. Here are some of the key players:

Novo Nordisk A/S is a multinational pharmaceutical company from Denmark that specializes in producing medications for diabetes care and other healthcare products. The company was founded in 1923 and is headquartered in Bagsværd, Denmark. Novo Nordisk is a global leader in diabetes care and provides a comprehensive range of insulin products, GLP-1 receptor agonists, and other related therapies. In 2023, the company's revenue was $33,709.9 million.

Eli Lilly is one of the oldest U.S. pharmaceutical companies. The company was founded in 1876 and is headquartered in Indiana, U.S. The company products are sold in approximately 120 countries. It has manufacturing plants in 13 countries, with R&D facilities in six countries. In 2023, the company's revenue was $ 34,124.1million.

Sanofi is a pharmaceutical company established in 1994 with 3 segments: pharmaceuticals, consumer healthcare, and vaccines. It operates 69 manufacturing sites in 32 countries. In FY2023, Sanofi's revenue increased by 3.1% compared to FY2022. This is due to higher sales of vaccines and Dupixent.

Medtronic is a global leader in diabetes management technology. Founded in 1949, the company is headquartered in Minnesota, U.S. Their insulin pump systems, like the MiniMed series, offer continuous subcutaneous insulin infusion for precise delivery. The integrated insulin pump systems, combined with continuous glucose monitoring, provide advanced tools for personalized diabetes management. In 2023, Medtronic's revenue was $31,227 million.

AstraZeneca is a multinational pharmaceutical company that specializes in various therapeutic areas such as cardiovascular, oncology, respiratory, and diabetes care. The company was founded in 1999 and has its headquarters in Cambridge, U.K. It markets its medicines in more than 100 countries and has a diverse portfolio of products. With over 600 collaborations worldwide, the company has expanded its pipeline portfolio. AstraZeneca operates manufacturing facilities in 18 countries and has a considerable presence in emerging markets, particularly China. Additionally, the company markets drugs for treating diabetes, and in 2023, it recorded a revenue of $45,811 million.

According to the report by BCC Research, the global market for emerging insulin drug and delivery technologies was valued at $55.8 billion in 2023. The market is expected to grow steadily at a rate of 9.8% from 2023 to 2028 and reach over $88.9 billion by the end of 2028. This growth is attributed to several factors, including the increasing prevalence of diabetes worldwide, which drives the demand for effective diabetes management solutions. Moreover, advancements in healthcare technology and infrastructure are facilitating the development of innovative insulin delivery devices with improved precision, user-friendliness, and patient comfort, thereby boosting market growth.

Consider becoming a member of the BCC Research library and gain access to our full catalog of market research reports in your industry. Not seeing what you are looking for? We offer custom solutions too, including our new product line: Custom Intelligence Services.

Contact us today to find out more.

Amrita Kumari is a Senior Executive Email Marketer at BCC Research, with a bachelor’s degree in computer applications. She specializes in content creation and email marketing.

In today’s fast-paced biomedical world, researchers and pharmaceutical companies...

Radiopharmaceuticals represent a cutting-edge frontier in modern medicine, offer...

Implantable Remote Patient Monitoring (IRPM) devices are revolutionizing healthc...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.