Oct 16, 2015

Blog Life Sciences Regulatory Benefits and Pharma Investments Driving Global Markets for Orphan Drugs to Reach $191 Billion

The orphan drug market is one of the pharmaceutical industry’s fastest-growing segments. Extensive research in this field has resulted in biological and non-biological therapeutic treatments for many unmet clinical and therapeutic needs of patients with orphan and rare diseases such as Gaucher’s disease, Pompe disease, cystic fibrosis, Hunter syndrome, tuberous sclerosis complex, chronic myelogenous leukemia, and others.

Recently, the global orphan drug market experienced a significant increase in the number of FDA-approved orphan drugs and their market availability. Indeed, thanks to technological advances, new product launches, and increasing assistance from regulatory bodies this market is expected to experience significant growth for the foreseeable future.

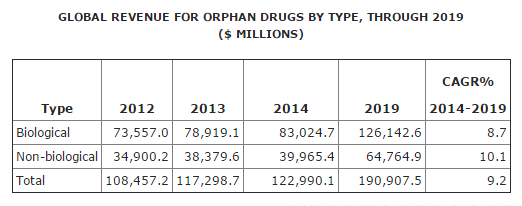

According to the BCC Research’s Global Markets for Orphan Drugs (PHM038E), the global orphan drug market, which can be characterized as either biological orphan drugs or non-biological or chemical orphan drugs, grew from $108.5 billion in 2012 to nearly $117.3 billion in 2013. The market will continue to grow at a healthy CAGR of 9.2% to reach nearly $191 billion in 2019.

“Regulatory benefits, like incentives, grants and government tax rebates, have encouraged a flurry of research and development activity,” said BCC Research pharmaceutical analyst Shalini Shahani Dewan. “Rising R&D spending, along with increased competition, new technologies and newer gene therapies, are really driving this market.”

Source: BCC Research, "Global Markets for Oprhan Drugs," September, 2015

BIOLOGICAL ORPHAN DRUGS

The approval of biological orphan drugs for multiple indications has been a significant growth factor for the overall market. For example, Ilaris (canakinumab) was an approved orphan drug for cryopyrin associated periodic syndrome (CAPS), but in 2013 was again given orphan approval in the U.S. and Europe for the treatment of acute gouty arthritis.

In the same year, the FDA approved the drug for the treatment of systemic juvenile idiopathic arthritis, while the European Medicines Agency (EMA) granted a label extension for CAPS indication of Ilaris for the treatment of CAPS, even in young children.

Biological orphan drugs like Humira (adalimumab) generated $10.7 billion in 2013. Remicade (infliximab) followed with $8.9 billion. Rituxan (rituximab) had $7.9 billion and Avastin (bevacizumab) had $7.1 billion sales in 2013. Other major revenue generators during 2013 included Herceptin (trastuzumab) with $6.9 billion, Avonex (interferon beta-1a) with $3 billion, Rebif with $2.1 billion, and Soliris (eculizumab) $1.6 billion.

The biological orphan drug market was almost $73.6 billion in 2012, and in 2013 the revenue grew to $78.9 billion. This market is expected to increase from $83 billion in 2014 to nearly $126.1 billion by 2019 at a CAGR of 8.7%. In 2013, sales of biological orphan drugs accounted for 67.3% of the total orphan drug market.

NONBIOLOGICAL OR CHEMICAL ORPHAN DRUGS

The global non-biological orphan drug market was boosted by successful product launches. In 2013, for example, Celgene launched Pomalyst (pomalidomide) in the U.S. and Europe for the treatment of multiple myeloma. It was well accepted in those markets, resulting in $305 million in sales during a six-month period (July to December).

Sales of non-biological drugs like Gleevec/Glivec (imatinib mesylate), Revlimid (lenalidomide), Velcade (bortezomib), Sprycel (desatinib) and Tasigna (nilotinib) have also influenced market growth since 2012.

In 2013, the non-biological orphan drug market had $4.7 billion in sales from Gleevec/Glivec (imatinib mesylate) alone. Revlimid (lenalidomide) claimed sales of $4.3 billion, Velcade (bortezomib) $2.5 billion, Sprycel (desatinib) $1.3 billion and Tasigna (nilotinib) $1.3 billion in 2013.

The market for these drugs is expected to grow with expanded indication approval of Novartis’s Tasigna (2010), label extension approvals of Bristol-Myers Squibb’s Sprycel (2007, 2009, 2010, 2013), and Novartis’ Gleevec/Glivec (2012, 2013). Label extension indicates the ability to use the approved drug for children or to treat other associated symptoms.

By 2019, the non-biological orphan drug market is projected to reach close to $64.8 billion with a CAGR of 10.1%. In 2013, non-biological orphan drugs accounted for 32.7% of overall market share.

MARKET LANDSCAPE

Over the past few years, the U.S. market for orphan drugs has been influenced by factors such as multiple drug approvals, increased label extensions, and improved healthcare infrastructure with a better understanding of disease manifestations and mechanisms.

The European market, which has well-categorized diseases and legislation similar to that of the U.S., has been boosted by an increased number of approvals within its well-established legal framework and is growing along with the U.S. market.

Because of its established framework, the use of orphan drugs is much higher in the U.S. and Europe as compared with emerging markets. Sales from the emerging markets are also expected to grow in the next five years due to the availability of orphan drugs in their markets and their outlook for addressing the orphan diseases with the help of U.S. and Europe orphan drug legislations.

For instance, Genzyme, an American biotech company, established the South African Foundation for Rare Disorders (SAFRD) to support patients with financial aid, emotional support and treatment options, and also connects them to other rare or orphan disease patient groups around the globe.

In May 2013, Amgen entered into a collaboration with Astellas Pharma Inc., a Japanese-based biotech company, in an effort to expand its business in major Asian markets. Through this collaboration, the companies are jointly developing and commercializing five innovative pipeline drugs to address gastric cancers in Asia, as well as metastatic cancers and hyperlipidaemia in China. Amgen plans to build new facilities in Japan and operate under the name Amgen Astellas BioPharma KK.

Further, GlaxoSmithKline reported that U.S. sales of Votrient (pazopanib) had increased 56% in 2013 and 91% in the EU, while the emerging markets and Asia-Pacific regions delivered an estimated 77% sales increase. Votrient’s global sales increased approximately 75% in 2013 compared with 2012. The approval of Votrient in Europe in August 2012, and its positive clinical studies as a treatment for advanced kidney cancers and soft-tissue sarcoma, aided its strong performance in Europe.

“The orphan drug industry is gaining importance as a significant and rewarding market in the pharmaceutical and biotech sectors,” said BCC Research’s Dewan. “Technological and scientific innovations in specific drug discovery pathways as well as major developments in genetics are cultivating growth in this industry.

In today’s fast-paced biomedical world, researchers and pharmaceutical companies...

Radiopharmaceuticals represent a cutting-edge frontier in modern medicine, offer...

Implantable Remote Patient Monitoring (IRPM) devices are revolutionizing healthc...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.