Permanent magnets are an integral part of several industries, such as automotive, renewal energy, healthcare and consumer electronics. Companies worldwide are focusing their R&D efforts on technological innovations to expand the applications of different types of permanent magnets in several end-user industries to provide state-of-the-art as well as energy-efficient products.

Technologies from wind turbines to electric vehicles rely on critical materials called rare-earth elements. Rare-earth elements have unique characteristics that make them very useful. For example, the world's strongest magnets are made with neodymium. A little too powerful for your refrigerator, these magnets are incorporated into computer disk drives, power windows and wind turbines.

Rare earths, though often abundant, are challenging to mine and process, and prices can rise quickly in a short period of time. Given the increasing demand for these elements, European researchers set out to find substitutes that could replace some rare-earth materials and help ensure the continued supply of products people have come to depend on.

As

reported in ACS' journal

Chemistry of Materials, researchers have devised a new way to make nanoparticles as a feasible alternative for use in rare-earth-free magnets. They used a mixed iron-cobalt oleate complex in a one-step synthetic approach to produce magnetic core-shell nanoparticles. The resulting materials showed strong magnetic properties and energy-storing capabilities. The researchers claim their approach could signal an efficient new strategy toward replacing rare earths in permanent magnets and keeping costs stable.

WHAT ARE RARE EARTH ELEMENTS?

Rare earth elements (REEs) consist of 17 elements,

according to BCC Research analyst Aneesh Kumar. Fifteen of REES belong to the chemical group lanthanides, which includes lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium elements. Neodymium, praseodymium and dysprosium elements are utilized in the production of neodymium magnets, while samarium is used for the production of samarium-cobalt magnets.

“REEs are used for a variety of applications in several industries such as in energy, consumer electronics, automobile, and aerospace and defense,” Kumar

says. “Increasing demand of automotive, industrial, home appliances and medical devices around the world, especially in the Asia-Pacific, North America and Europe regions, is increasing the demand of various types of permanent magnets.”

“Among the permanent magnet types, neodymium and ferrite magnets combined account for 99% of the volume market, and are the most prominently used in critical technologies such as automotive, power generation and electronic goods. “

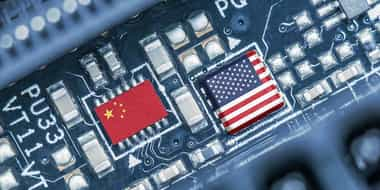

CHINA: RARE EARTHS SUPPLIER TO THE WORLD

China is the world’s largest producer of all types of permanent magnets, with particularly a high control over rare earth permanent magnets.

According to Kumar, China remains the dominant supplier of REEs raw materials as well as downstream oxides, and even metals and alloys associated with these elements, and accounts for over 95% of the global output of rare earth minerals to the world.

“In 2014, Chinese authorities reduced the amount of rare earth resources allowed to be exported by 2.5%, with only 27 rare earth manufacturers and distributors given permission to export a combined total of 15,110 metric tons during the first half of 2014,” notes Kumar. “In addition, during the second half of 2014, the allocated amount was about 15,501 metric tons, with a combined total of the year at 30,611 metric tons.

Kumar says that the European team of researchers’ strategy for rare-earth free magnets could lessen global dependence on China’s reserve, which he says accounts for close to 80% of the Japan REEs imports and almost 100% for some REEs import of the U.S.

“To source these raw materials across the globe to be utilized in several end-user industries, ranging from home appliances to automotive and aerospace and defense, China’s restrictions on the export quota of these materials to protect and utilize it as strategic minerals, in addition to brewing internal demand for these elements, pose a great challenge for other economies to find other alternatives or become self-sufficient by exploring activities to produce REEs on their own,” he observes.

Kumar

anticipates the global permanent magnet market to grow from nearly $13.4 billion in 2015 to about $20 billion by 2020, with a five-year (2015-2020) compound annual growth rate (CAGR) of 8.4%.