The world's largest engineered ceramics manufacturer acquired one of the largest CIM companies in the world last month. With the acquisition of Philips Ceramics, Colorado-based CoorsTek expands its ongoing strategic partnership with Philips, a producer of ceramics based in Uden, Netherlands.

Adding Uden extends the CoorsTek footprint to a dozen European manufacturing locations—in the Czech Republic, England, Finland, Germany, Italy, Netherlands, Norway, Scotland, and Sweden.

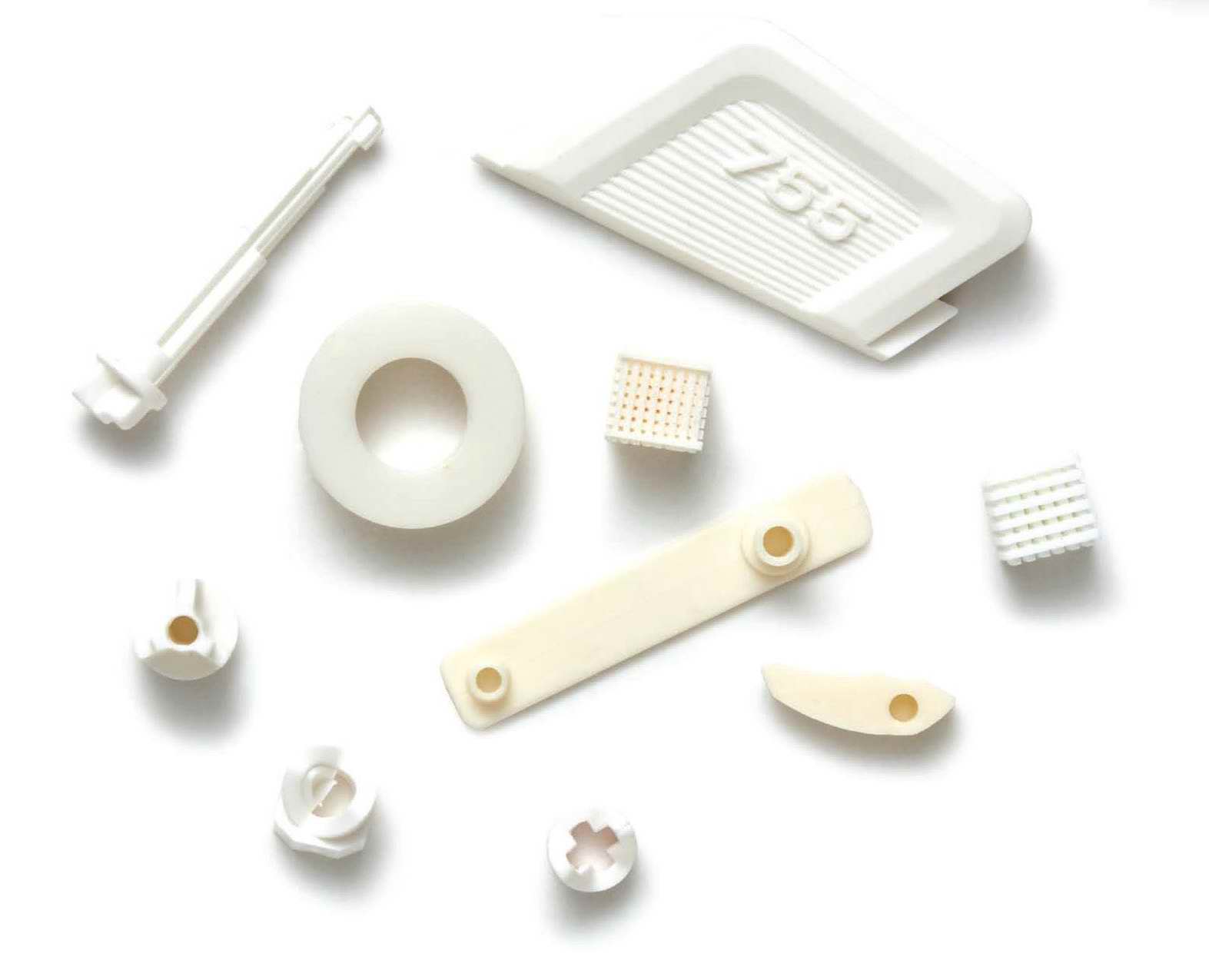

The move combines Uden-based Philip’s 60 years of engineering know-how and manufacturing capabilities with the ceramics expertise CoorsTek has developed over the past century. Using advanced ceramic injection molding (CIM) and automated volume manufacturing, Philips can produce millions of high-purity ceramic parts each year.

"The Uden team will help support our expanding customer base across Europe and around the world," said Andreas Schneider, executive vice-president of CoorsTek in Lauf, Germany.

CoorsTek serves over 10,000 technology and manufacturing customers in 70 countries, delivering local service from its network of 50 locations on four continents.

WHAT IS METAL INJECTION MOLDING?

Metal injection molding (MIM) is a manufacturing technology that combines the design flexibility of plastic injection molding with the material flexibility of powder metallurgy, creating parts that have the strength and integrity of wrought metals, thus providing value-based solutions in the manufacturing of complex parts,

according to BCC Research analyst Vijay Subramanian.

Ceramics typically are materials that are neither organic nor metals, he explains. “There are four basic classes of ceramics: oxide ceramics (alumina, magnesia, zirconia, mullites); non-oxides (carbides, nitrides); glasses (silica and boron-oxide base materials); salt (chlorides, sulfates, nitrates). Commercially, the oxide ceramics are the largest class, followed by glasses and non-oxide ceramics. Salt ceramics are minimally used.”

Ceramics parts manufacturers often use several processing technologies, including pressing, tape casting, machining and ceramic injection molding, all in one manufacturing location, he adds.

COORSTEK AND PHILIPS CERAMICS

Philips Ceramics core business is the development and manufacturing of translucent ceramics for high-intensity discharge lamps, according to

Subramanian. As noted in the

announcement of the acquisition. In addition to securing an exclusive, long-term agreement to supply Philips Lighting, CoorsTek will use Philips’s capabilities to serve a broader set of customers and applications beyond lighting—including automotive, electronics, and medical.

CoorsTek. Founded by Adolph Coors as Herold China and Pottery Co. in 1910, CoorsTek became an independent company in 2000. The CoorsTek company has grown through acquisitions over the last decade and claims to the world’s largest ceramic product manufacturer, supplying all high-tech industries with technically advanced products. Subramanian

estimates the company’s revenues at $1.3 billion in 2015.

In December 2014 the company made the largest acquisition in its history by purchasing Covalent Materials Corp., formerly Toshiba Ceramics Co., for $450 million. Since 2007, CoorsTek has acquired eight companies, including Philips Ceramics and Covalent Materials.

Philips Ceramics. Over the last 10 years Philips has invested heavily in the development of CIM production. The investments in mechanization and CIM technology have resulted in a production facility that delivers high quality products against the lowest possible price, notes Subramanian.

With an annual CIM production capacity of over 25 million translucent ceramic components, the company claims to be the largest ceramic injection molding facility in the world. Over the last years the company has been expanding its product portfolio to include non-lighting ceramic components.

MIM AND CIM GLOBAL MARKETS HEATING UP

According to Subramanian, the global markets for metal injection molding (MIM) and ceramic injection molding (CIM) have exhibited spectacular growth over the last two decades.

“What the world saw in plastics with injection molding in the last 50 years is now being replicated in the metals and ceramics industries,” he says. “Since the market slowdown in 2008 and 2009, the global automotive industry has been on a growth path, and this has helped the MIM market grow significantly. This is all the more important due to the recent slowdown in the firearms market.”

Subramanian

projects the global MIM and CIM market to grow at a compound annual growth rate (CAGR) of 7.6% to reach $3.1 billion in 2020, up from $2 billion in 2014.