Apr 4, 2024

Blog Digital World Explore the Hybrid Operating Room Equipment Market by Startups

Hybrid operating rooms (HORs) are multipurpose rooms designed for numerous surgical disciplines, such as cardiology, neurology, orthopedic, and others. Equipment in hybrid operating rooms includes surgical tables, high-resolution monitors, imaging systems, and specialized tools tailored for both open and minimally invasive surgeries. The adoption of interoperative imaging during surgeries is the future of surgery and has led to the adoption of HORs. These rooms allow surgeons to perform diagnosis, imaging, surgery, and biopsy all in the same room which reduces need to move patient between imaging suite and operating room.

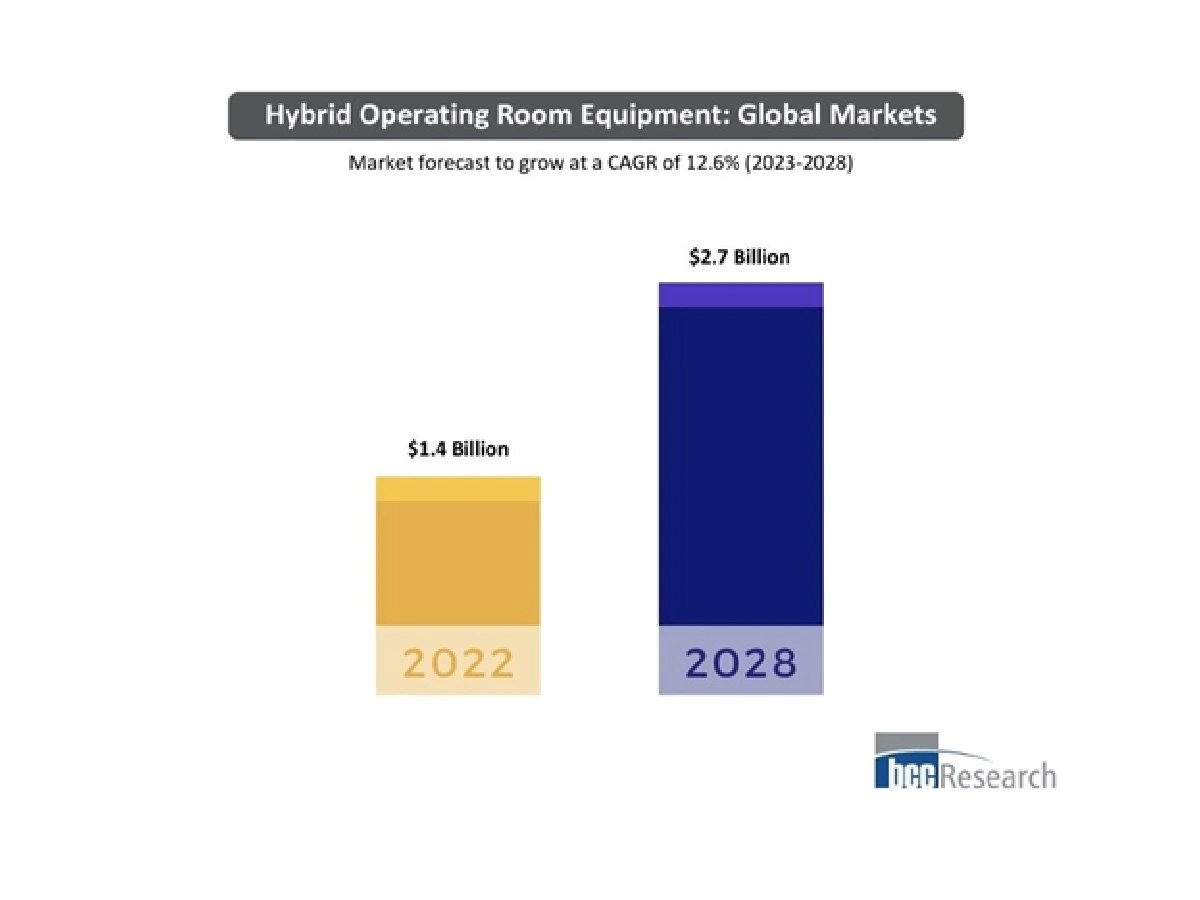

BCC Research expects the global market for hybrid operating room equipment to grow at a compound annual growth rate (CAGR) of 12.6% to reach $2.7 billion by 2028. This growth is driven by key factors such as increasing demand for minimally invasive surgeries, rapid advancements in imaging systems, and the adoption of robotic surgery. Additionally, the increasing number of surgical application areas will also inject growth within the market

The global hybrid operating room equipment market was valued at $1.4 billion in 2022 and will reach $2.7 billion by 2028.

Advanced technologies and growing investment in the medical device sector are also influencing this market. Let’s dive into the top companies in this market.

Getinge is the first leading healthcare company in the list. Founded in Sweden in 1904, the company offers a wide range of solutions to over 25,000 customers worldwide, including the 10 largest hospitals in its markets.

Additionally, Getinge provides equipment and systems for critical care areas such as intensive care units (ICUs) and emergency departments, including ventilators, heart-lung machines, and other life-supporting devices. With 17.5% of the total, Getinge held the highest market share in 2022.

Stryker held the second-largest market share at 10.2% in 2022. It is a leading global medical technology company headquartered in Kalamazoo, Michigan, United States, established in 1941. Stryker's major products include medical and surgical equipment. In the United States, most of Stryker's products are marketed directly to doctors, hospitals, and other healthcare facilities. Internationally, its products are sold in over 100 countries.

Stryker launched its Q Guidance System for spine applications in September 2022.

STERIS held a market share of 7.4% in the hybrid operating room equipment market in 2022. The company is a leading global provider of products and services that support patient care, with an emphasis on infection prevention. It has approximately 16,000 associates worldwide and operates in more than 100 countries.

The Hybrid Operating Room (HOR) Equipment market is experiencing increasing global demand due to its advantages in patient safety, cost savings, operational efficiency, and reduced operating time. BCC Research forecasts that this market will reach $2.7 billion by 2028, growing at a rate of 12.6% annually. Overall, the future of the HOR equipment market looks promising.

Consider becoming a member of the BCC Research library and gain access to our full catalog of market research reports in your industry. Not seeing what you are looking for? We offer custom solutions too, including our new product line: Custom Intelligence Services.

Contact us today to find out more.

Heena Singh is a Senior Executive Email Marketer at BCC Research, with a master’s degree in computer applications. She specializes in content creation and data analytics.

From smartphones to satellites, antennas play a vital role in enabling the seaml...

Introduction Artificial Intelligence (AI) and the Internet of Things (IoT) are r...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.