Dec 14, 2015

Blog Life Sciences Enthusiasm for Cancer Immunotherapy Remains Unchecked

Cancer immunotherapy has been pegged as one of the most promising long-term investment opportunities. It’s easy to see why—the level of R&D activity in this field is dizzying. An earlier BCC Research blog found that within a six-month period from April to September of this year, cancer immunotherapy deals easily totaled at least $8 billion. A look at the months that have passed since shows the pace hasn’t slowed one bit. Selected activity is highlighted below.

DECEMBER SO FAR...$2 BILLION

Earlier this week, SQZ Biotech and Roche partnered up with a $500+ million deal. They plan to develop a cell therapy platform that harnesses a patient’s own immune cells. The proposed therapy would use SQZ's technology to introduce proteins into a patient’s B cells, which would then help activate killer T cells to attack the cancer.

The same day, BioAtla and Pfizer announced a $1B pact for a new class of antibody therapies. These will be based on BioAtla's Conditionally Active Biologic (CAB) platform, using Pfizer's proprietary antibody-drug conjugate (ADC) payloads. Pfizer also gains an exclusive option to BioAtla’s CAB antibodies that target CTLA4, which is a validated immuno-oncology target. The news comes 2 weeks after Pfizer’s megamerger with Allergan.

Then, two days later, Roche struck a second cancer immunotherapy deal, this time with Pieris, worth approximately $409 million. Pieris will discover, characterize, and optimize its proprietary Anticalin-based drug candidates against an undisclosed target. Roche and Pieris will evaluate different drug formats against this target and advance them through preclinical development, with Roche responsible for IND-enabling activities, clinical development, and worldwide marketing of any resulting products.

OCTOBER...$2.3 BILLION

The start of October saw XOMA and Novartis ink a $517 million immuno-oncology deal for first-in-class anti-transforming growth factor (TGF)-beta antibodies. XOMA exclusively licensed the global development and commercialization rights to its anti-TGF-beta antibody program to Novartis. The agreement called for XOMA to receive $37 million upfront and potential milestone payments totaling up to $480 million.

The middle of October revealed a major $1.74 billion immuno-oncology deal between Bristol-Myers Squibb and Five Prime Therapeutics. The companies will seek to develop and commercialize Five Prime's colony stimulating factor 1 receptor antibody program. The deal includes FPA008, which is in Phase I for immunology and oncology indications. This agreement replaced the existing collaboration between the companies, which was to evaluate the combination of Opdivo (nivolumab), Bristol-Myers Squibb's programmed-death 1 (PD-1) immune checkpoint inhibitor, with FPA008 in six tumor types. The new agreement calls for an upfront payment of $350 million to Five Prime, which will also be eligible to receive up to $1.39 billion in milestone payments.

Also in October, Novartis took steps to broaden its immuno-oncology pipeline with the acquisition of Admune Therapeutics and through licensing agreements with Xoma and Palobiofarma. These transactions add Admune's IL-15 agonist program, Palobiofarma's adenosine A2A receptor antagonist, and Xoma's TGF-beta inhibition programs to Novartis’ immuno-oncology portfolio.

Novartis and Palobiofarma’s $15 million agreement gives Novartis the exclusive global rights to develop, manufacture, and commercialize Palobiofarma’s adenosine A2A receptor antagonist, PBF-509, which is set to begin Phase I trials for non–small-cell lung cancer. Palobiofarma said its molecule could be used in combination cancer therapy with other drugs, including anti–PD-1 and anti–PD-L1.

WHEN TWO IS BETTER THAN ONE...

BCC Research’s previous post also noted a trend toward companies pairing up to develop novel combination immunotherapies, a practice that continues. Last week, Amgen and Merck inked an immunotherapy pact to support a Phase Ib/III study investigating BLINCYTO (blinatumomab) in combination with KEYTRUDA (pembrolizumab) in patients with diffuse large B-cell lymphoma. BLINCYTO is Amgen's CD19 bispecific T-cell engager and KEYTRUDA is Merck's anti–PD-1 therapy.

The companies also announced a second immunotherapy collaboration to support a Phase I/II study of AMG 820, Amgen's anti–colony-stimulating factor 1 receptor antibody, in combination with KEYTRUDA in patients with select advanced solid tumors, including non–small-cell lung, colorectal, and pancreatic cancers.

And, just today, Eli Lilly and Merck said they will team up to conduct a Phase I study to assess the combination of Lilly's cyclin-dependent kinase 4 and 6 inhibitor, abemaciclib, with Merck's KEYTRUDA, across multiple tumor types. Depending on the Phase I trial results, the collaboration could progress to Phase II trials in metastatic breast cancer or non–small-cell lung cancer, according to the companies.

KEYTRUDA is a humanized monoclonal antibody that works by blocking interaction between PD-1 and its receptor ligands, PD-L1 and PD-L2. KEYTRUDA has garnered a lot of attention lately; it is credited (alongside surgery and radiation) with eradicating former US president Jimmy Carter’s brain cancer.

CAR-T STILL IN THE SPOTLIGHT...

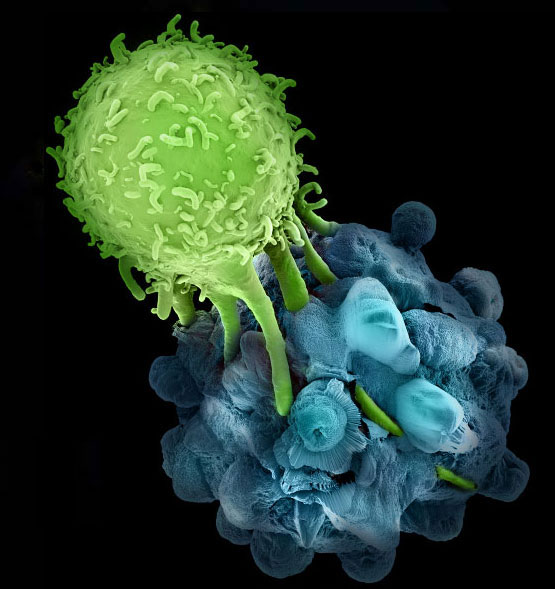

BCC Research’s earlier post highlighted the buzz about the immunotherapy known as CAR-T, which is a method of modifying immune cells to fight cancer. (CAR-T cells are a patient’s own T cells altered outside the body to be cancer killers, then put back in to go after tumor cells.) This optimism remains afloat.

A few weeks ago, Servier opted in for Cellectis’ UCART19, then promptly partnered it with Pfizer. Per a 2014 agreement, Servier early exercised its option to acquire the exclusive worldwide rights to UCART19, which is a TALEN (Transcription Activator-Like Effector Nuclease) gene-edited allogeneic CAR-T therapy about to enter Phase I for leukemia. This prompted a $38.2 million payment to Cellectis, which is also eligible for over $300 million in milestone payments, R&D financing, and royalties on sales.

In turn, Servier struck an exclusive deal with Pfizer to co-develop and commercialize UCART19. Pfizer will be responsible for potential commercialization of UCART19 in the United States, and Servier will retain marketing rights outside the United States.

Mark Haefele, global chief investment officer of the Swiss bank UBS, which has $2 trillion under its management, has recently said that investment in cancer immunotherapy offers the potential for attractive returns. Haefele cited that spending per cancer patient has risen about 60% between 2010 and 2014, and that early immunotherapies are costing upward of $100,000. (See Business Insider’s article.)

It inspires a lot of hope and anticipation for what the remaining weeks of 2015 and the year 2016 will bring.

In today’s fast-paced biomedical world, researchers and pharmaceutical companies...

Radiopharmaceuticals represent a cutting-edge frontier in modern medicine, offer...

Implantable Remote Patient Monitoring (IRPM) devices are revolutionizing healthc...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.