Apr 4, 2023

Silicon Valley Bank's (SVB) collapse has direct and indirect implications and effects across the global financial markets. First, a bank run is defined as a sudden and dramatic increase in withdrawal of deposits from a bank. SVB was subject to a bank run largely in venture capital and corporate withdrawal of deposits, to an extent that SVB was then forced to sell reserve assets in the form of U.S. Treasuries and Mortgage Backed Securities (MBS).

When Silicon Valley Bank was forced to sell these assets, they realized significant losses (to Goldman Sachs GS) on those reserves. To make up for these losses, they attempted to sell stock, which initiated a massive selloff and further withdrawal of deposits, so much so that they were unable to meet their regulated leverage ratios and fulfill these withdrawals, while simultaneously unable to borrow money from other financial institutions to meet these demands.

California's Department of Financial Protection and Innovation (DFPI) placed the Federal Deposit Insurance Corporation (FDIC) as administrator over the bank's assets and transferred these to a newly created "bridge" entity titled Deposit Insurance National Bank of Santa Clara (DINB). Now, the Federal Reserve, in conjunction with other US financial and banking regulators (of which there are many), are working to find an appropriate buyer of Silicon Valley Bank's various assets.

This is a historic moment, but it requires perspective. Silicon Valley is only ranked 16th in asset size for US banks, and there have been 122 bank failures in America since 2012. Credit Suisse (CS) was the first major financial institution to have a bank run recently (October 2022). First Republic Bank (FRC) is in the midst of their own bank run via stock selloff and depositor withdrawals and ranks two places higher in asset size. SVB and FRC had just over $200 billion in assets each, which is miniscule compared to Wells Fargo (4th largest U.S. bank with $1,700 billion in assets) and JP Morgan (1st largest US Bank with $3,200 billion in assets).

The United States banking and financial regulators have jointly protected all depositors of SVB, now DINB, via the Deposit Insurance Fund (DIF) at the FDIC, which exists from banks paying insurance fees on their deposits. JP Morgan, first and then JP Morgan and friends again, have loaned money to First Republic to fulfill leverage and financial requirements, and the Federal Reserve Bank (FRB) has increased funds available for lending to the banking industry as a whole. The banking and financial industry is doing its best to stabilize things and stop the spread of panic! Oh, and Signature Bank failed just two days after SVB, but sat at only half the size in assets.

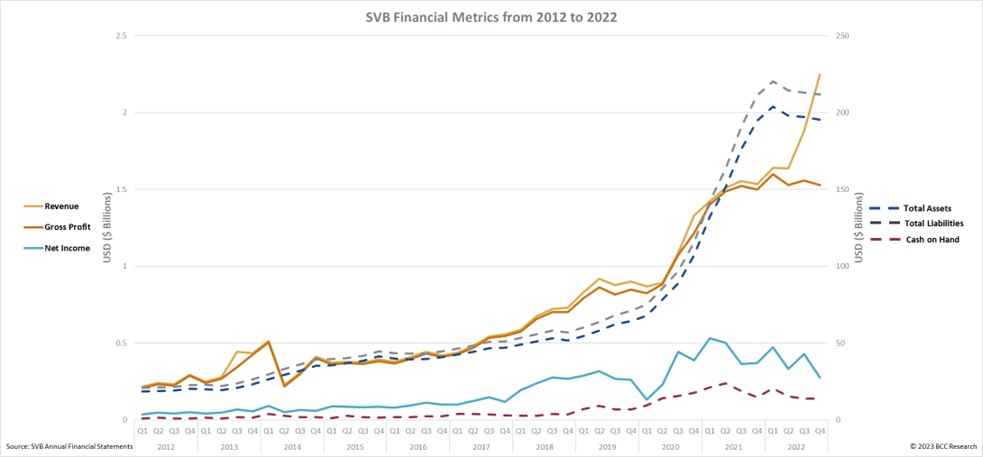

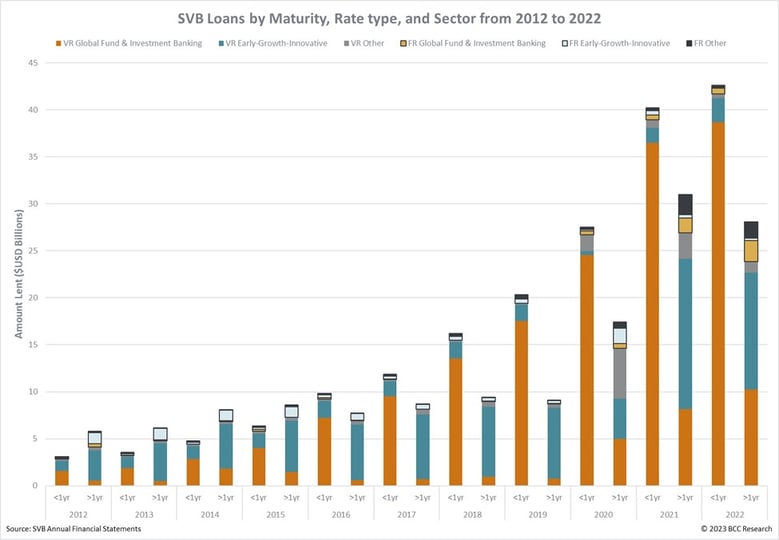

Starting on the micro side of this story, SVB is known as "the tech and biotech bank", but in reality, much more indirectly so. SVB's financial reports show loans were predominantly to the global fund banking sector, or "global private equity and venture capital clients". Over 90% of their $68 billion in loans were variable rate, and $38 billion of that had maturity dates of less than one-year for private equity and venture capital groups specifically. Furthermore, their historical financial reports show a pattern of less than one-year variable rate loans renewed annually at increasing quantities for SVB’s global fund banking segment. Non-global fund banking loans are segmented across selective criteria, but companies in line with the tech and biotech sector only accounted for sub-$7 billion, or less than 10% of their total loan profile. Compared to nearly $10 billion lent to high-wealth individuals, SVB's original image doesn't perform well. That same performance is seen in SVB's recent loans in Early and Growth sectors, with nearly a third already non-performing from 2021. In the end, and perhaps the end for Silicon Valley Bank, $13.8 billion in cash on hand with $40 billion in annually recycling variable rate loans in the background of drastic interest rate increases, deteriorating liquidity, and loss of global central bank "quantitative easing" policies, was just not enough. What might have begun as a lifeline for growth quickly turned to a means of destruction.

Moving to the macro, regulations and regulators failed to prevent a major bank collapse, but pseudo-succeeded in choosing to protect only the depositors. All the persons and businesses with money at SVB will have access to their money, all debtors to SVB will still have to pay off their debt, but the bank's shareholders and bondholders will incur heavy losses to the reduced price someone is willing to pay for the various remaining unsold assets, debts, and deposits of the bank, if there is an offer at all. SVB's clients were global, as were its investors. Banks and non-bank financial institutions that are tightly intertwined with and in SVB's business are out a partner and investment, while coming to realize their own losses on those same reserve assets.

The most significant aspect of SVB's failure is in the loss of liquidity and strength in commonly safe asset markets, such as U.S. Treasuries and MBS. A Lannister always pays his debt and so does the U.S. Government*. However, the value of those IOUs has dramatically decreased over the last couple of years. SVB met all regulatory requirements and internationally agreed standards on liquidity and margins, with a high percent of the golden-CET1 ratio, until they didn't. The cherry on top: someone screamed bank run, and people ran. Images and videos of long lines of depositors running met with significant decreases in stock prices for many banks.

Safeguarding assets now, finding funding for tomorrow, and balancing on the tectonic shifts across the financial industry are a heavy burden. Tie in strategic positioning and rotating through the micro and macro-economic environment; this will be the most challenging business environment since 2008, if not more so. SVB's loss places a hole in the lending schema for many across private equity, venture capital, and early-stage companies considered innovative or otherwise. SVB's failure places a question on the profitability and stability in investing across these sectors in non-conforming methods. While the backstop for depositors protects businesses, banks are digesting the realization of true risk amid the realization of losses. While protecting depositors was the right move to protect the working economy, there is valid concern that many of those deposits are unjustified given the bank's history of clientele. The Federal Reserve commanded 'Slow', but without novel solutions and more careful oversight, they'll get a 'Stop'.

*The Lannisters' are a notoriously wealthy family from the fictional series The Game of Thrones. The US Government's commitment to pay may be absolute, but congressional enablement is required every once in a while.

The past few years saw an unprecedented mix of factors impact the resilient glob...

The mobile wallet and payment technologies industry is shifting toward digitizat...

Fintech is making waves in the traditional financial sector, adopting innovative...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.