Apr 22, 2021

Blog Energy & Sustainability Birth Of Precision Farming

What Is Precision Farming

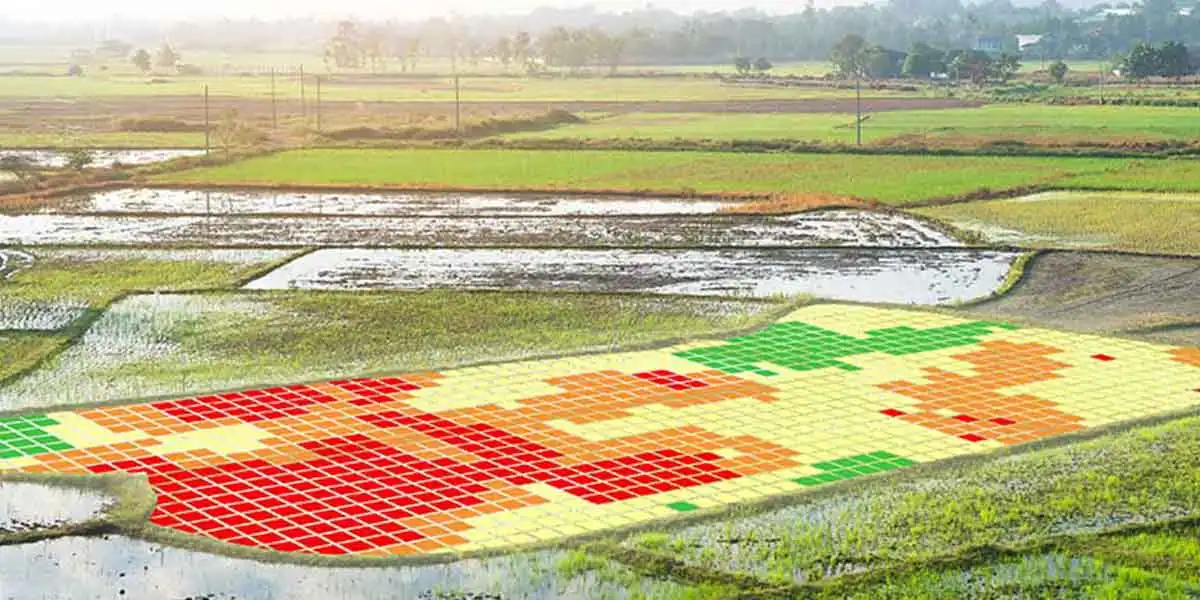

Precision farming includes various hardware technologies such as automated systems, control systems, sensing and monitoring devices, as well as software solutions such as farm management software. In precision farming, software and hardware work in conjunction. A strong precision farming tool system will have multiple hardware and software solutions integrated seamlessly.

History And Evolution Of Precision Farming

While the use of advanced technology in agriculture can be traced back to the 1980s, the use of precision farming technology started in the U.S. a decade later. Since 1989, many U.S. farmers used low-input sustainable agriculture (LISA) techniques to reduce the usage of chemicals. This was followed by the use of yield monitors, the internet and global positioning systems.

The first yield monitor was created in 1992 and further allowed adoption of technology in farming. Early usage of precision agriculture was limited to grid sampling, mapping for fertilizers, pH soil corrections and yield measurements. The use of technology increased by 1994 with satellite technology (GPS) and variable rate technology. This period also witnessed the FDA's first approval for a whole food produced through biotechnology, the FLAVRSAVR tomato.

The 21st century saw further developments in precision agriculture and strong acceptance of new technologies. In 2001, the European Commission released a 15-year study that found that biotech products did not pose any extra risk to human health or the environment. The study, which challenged popular belief at the time, was based on work from more than 400 research teams on 81 projects and helped to pave the way for biotech products. Technology uptake became more prominent and precise with increasing usage of auto guidance systems and made the protection and prediction of crop and seed more accurate, thus considerably improving the output.

Continued development and focus on the precision farming technologies segment can be further gauged by the fact that since the early 2000s, private-sector food and agricultural research and development spending grew at a much faster pace than public sector R&D, and by 2014, private sector R&D spending was almost three times that of the public sector’s R&D spending.

Current Trends In Precision Farming

Use and adoption of precision farming technologies is also related to the size of farms. While some emerging countries still have very small individual farm spaces, most of the developed regions (and high value precision farming technologies regions) have witnessed a growth in farm size (area).

This trend is visible in countries such as Australia and the U.S. and across various countries in Europe. For example, in the U.S. between 1987 and 2018, the percentage of cropland on farms with at least 2,000 acres more than doubled from 15% to 36%. Technologies such as GPS guidance systems, yield, soil mapping and variable-rate technology offer a better and more efficient output and hence their usage seems to have led to an increase in farm size and vice-versa.

The agriculture sector’s increased demand for precision farming technologies also helped end users to reduce their carbon footprint. By 2006, it is estimated that no-till farming led to a global reduction of 14.76 billion kg of carbon dioxide, the equivalent of removing 6.56 million cars from the road for one year. Introduction of biotech crops also decreased the usage of pesticides. Global pesticide applications have decreased 6% since the introduction of biotech crops, equivalent to the elimination of 379 million pounds of pesticides.

However, precision farming has been mostly adopted in the developed regions—Western Europe and North America. One key reason for low adoption of precision farming technologies in emerging regions is the lack of technological knowledge. Additionally, lack of government incentives and financing, high initial investments and lack of local vendors are other factors leading to slower adoption of precision farming in the emerging regions.

Another factor which negatively impacts adoption in some emerging regions is small farm/agricultural areas as the breakeven time would be too long. One such country is India where most of the farm lands are too small to have precision farming technologies implemented. The breakeven time in comparison to yield would be very high, thus negating the positive benefits of precision farming technologies.

Future Trends In Precision Farming

Automatic machine setting optimization, on-machine soil condition sensors and basic crop condition sensors are some of the technologies that are expected to see strong adoption in the coming years. The frequent introduction of new technologies is further expected to witness changes in the precision farming market with technologies such as advanced crop condition sensing, machine platoon and multifunctional drones coming into effect post-2020. The next few years also expect to see the introduction of open data platforms.

Further developments in precision farming will include the use of augmented reality and usage of highly automated machines. In addition, a combination of various technologies along with human involvement is expected to give rise to a new area, Cobotics—the use of advanced robotics and machines along with human inputs and decision-making.

Market Players In Precision Farming

BASF SE

Established in 1865 and is headquartered in Rheinland-Pfalz, Germany. The company focuses on chemicals, agricultural products and intermediate solutions and services. BASF’s business units include: chemicals, functional materials and solutions, agricultural solutions, performance products and oil and gas.

Dupont

Science-based products and services company supporting markets including agriculture and food, building and construction, communications and transportation. Established in 1802 and has operations in more than 90 countries. DuPont focuses on agriculture and nutrition, advanced materials and industrial biosciences.

AG Leader Technology

Provides a wide range of precision farming technology solutions, based in the U.S. and was founded in 1986. The company sells its products through dealers in the U.S. as well as through regional sales representatives in both its home market and Canada.

Precision Planting

Leading pure play company in precision agriculture. Acquired by Monsanto in 2012. Founded in Central Illinois in 1995. Focuses on the development of innovative products that improve the planting process. Represented in the continental U.S. by a network of over 700 dealerships. In 2017, AGCO completed the acquisition of Precision Planting.

Additional Intel On Precision Farming

Sarah Greenberg is the Manager of Content Marketing at BCC Research. She creates our blog, social media and email content.

Electrical switches—devices that control the flow of electricity—are the backbon...

As the world accelerates toward net-zero emissions, hydrogen, and ammonia have e...

Hydrogen technology is widely used across industries like glass, fertilizer, met...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.