Aug 22, 2016

Blog Life Sciences Biosimilar Therapies for Rheumatoid Arthritis Win Favor of FDA Panel

The race is on to get biosimilar versions of the rheumatoid arthritis (RA) treatments Humira, the world’s top-selling drug, and Enbrel, also in the top five, to market. Companies are simultaneously defending their own biologic treatments and developing biosimilars. Case in point: Last month, Amgen floated on a recommendation from an FDA panel to approve its alternative to AbbVie’s Humira. But the following day, Novartis’ Sandoz division won similar support for FDA approval of a biosimilar to Amgen’s Enbrel. The landscape is changing fast, as companies both vie to protect their blockbusters and try to chip away at their competitor’s market share.

“Worldwide, the value of the biosimilars market will grow from about $174 million in 2014 to almost $5.4 billion in 2020 due to the introduction of [new] biosimilars,” says BCC Research analyst Geeta Ogra Bedi. “Presently, a growing number of biosimilars are in the late stage of clinical development.” BCC Research reveals in its new analysis that the biosimilars market should grow at a staggering five-year (2015–2020) compound annual growth rate (CAGR) of 71%.

MAKERS OF ENBREL AND HUMIRA TACKLE BIOSIMILAR THREATS

AbbVie’s Humira (adalimumab) was first approved in 2002 to treat RA in adults who had an inadequate response to a disease-modifying antirheumatic drug. Over the years, Humira has been tested in and approved for nine more indications, each of which has added to its top-selling status. Humira reportedly accounted for 60% of AbbVie’s total 2015 revenues (Rheumatoid Arthritis News). An FDA-approved Humira biosimilar could introduce price competition and save insurers, physicians, and patients billions of dollars, according to a Rand Corporation analysis.

Last month, the US FDA Arthritis Advisory Committee did unanimously support Amgen’s drug candidate ABP 501 as a biosimilar to AbbVie’s Humira. Amgen is seeking to license ABP 501 for five of the indications treated by Humira: RA and plaque psoriasis, as well as ankylosing spondylitis, adult Crohn’s disease, and adult ulcerative colitis. If the FDA follows the recommendations of its advisory committee, it will approve the Humira biosimilar.

If approved, it could still be a few years before Amgen’s biosimilar comes to market. Humira, a top candidate for biosimilar competition with approximately 20 copies of it in development, is shielded by more than 70 patents. AbbVie has said the patents should maintain the drug’s market share until at least 2022 (MarketWatch). According to an Amgen press release, the FDA could make its final decision on ABP 501 by September 25, 2016.

The active ingredient of ABP 501 is an anti-TNF monoclonal antibody that has the same amino acid sequence as Humira, and the same pharmaceutical dosage form, strength, and route of administration. Amgen’s data supporting ABP 501’s biosimilarity to Humira include results from two Phase III studies investigating ABP 501’s performance in treating moderate-to-severe plaque psoriasis and moderate-to-severe RA. Amgen said the Phase III studies met their primary end points showing ABP 501’s clinical comparability to Humira, and that its safety and immunogenicity characteristics were also shown to be comparable to Humira’s.

BUT ON THE FLIP SIDE...

Even as Amgen is gunning for approval of a biosimilar that would compete with AbbVie’s Humira, it is fighting to protect its own blockbuster biologic for RA, Enbrel (etanercept). Just as is the case for Humira, Amgen’s sales of Enbrel could face a decline due to the introduction of biosimilars and generics. Last year, an Enbrel biosimilar developed by Samsung Bioepis and Biogen was launched in Europe. In the United States, the same FDA advisory committee mentioned above has recommended Sandoz’ biosimilar version of Enbrel.

The FDA Arthritis Advisory Committee voted 20-0 in favor of recommending the approval of Sandoz’ GP2015 for the five indications approved for Enbrel. The recommendation was based on the totality of evidence from Sandoz’ global development program, showing that its biosimilar etanercept is highly similar to Enbrel, the company reported in a July press release. Enbrel, which is a TNF inhibitor, was approved by the US FDA to treat RA, juvenile rheumatoid arthritis, psoriatic arthritis, plaque psoriasis, and ankylosing spondylitis.

Currently, Samsung Bioepis has a pipeline of six biosimilar drugs. Of these, two autoimmune disease drugs (Benapali and Flixaby) have already been approved in Korea and Europe. Benapali, which is the Enbrel biosimilar, and Flixaby, a biosimilar of Remicade (infliximab), were launched in Europe. Samsung Bioepis has also filed a new drug application for SB5, which is a biosimilar version of Humira, in Europe.

BIOSIMILARS WILL GALVANIZE THE GLOBAL MARKET FOR RA THERAPIES

The biosimilars market will witness incredible growth worldwide. Robust adoption of biosimilars is expected in the seven major global markets, where healthcare providers are pushing for more affordable options to high-cost biologic therapies, particularly for chronic immunological diseases.

RA is a chronic inflammatory disease characterized by progressive joint damage, disability, and systemic complications. The goal of treatment in RA is to achieve clinical remission. When remission, defined as the absence of signs and symptoms of inflammation, is unattainable, the target of treatment is to lower disease activity, particularly in patients with established RA.

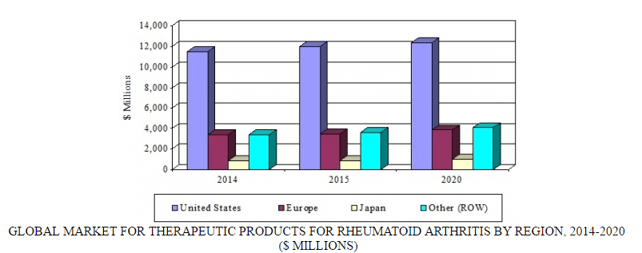

According to BCC Research, the global market for RA therapies is expected to grow from $19.9 billion in 2015 to nearly $21.3 billion by 2020, reflecting a five-year CAGR of 1.3%. As a therapeutic class, anti-interleukin biologics should grow from nearly $1.2 billion in 2015 to $1.5 billion in 2020 at a five-year CAGR of 4.4%. Biosimilars as a therapeutic class should reach nearly $5.4 billion in 2020 with a five-year CAGR of 71.0%, up from an anticipated $368 million in 2015.

In the seven major markets (United States, France, Italy, Germany, Spain, United Kingdom, and Japan), the market for RA treatments is expected to reach $16.3 billion and $17.2 billion in 2015 and 2020, respectively. The introduction of biosimilars for major products such as adalimumab, etanercept, infliximab, and rituximab will impact market growth. The market in the rest of the world, including India and China, should total $3.6 billion and $4.1 billion in 2015 and 2020, respectively. The introduction of cheaper biosimilars and Janus kinase inhibitors will drive market growth.

GLOBAL MARKET FOR THERAPEUTIC PRODUCTS FOR RHEUMATOID ARTHRITIS BY REGION, 2014-2020

BCC Research’s new study, Therapies for Rheumatoid Arthritis: Technologies and Global Markets, provides perspective on therapies used in the management of RA. New products and technologies, and their effects on the RA treatment sector, are analyzed by market share, product type, and geography. Global market drivers and trends, with data from 2015 and projections of CAGRs through 2020, are provided.

In today’s fast-paced biomedical world, researchers and pharmaceutical companies...

Radiopharmaceuticals represent a cutting-edge frontier in modern medicine, offer...

Implantable Remote Patient Monitoring (IRPM) devices are revolutionizing healthc...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.