Mar 28, 2017

Blog Life Sciences Asia-Pacific, Kidney Disease Spur Erythropoietin Biosimilars Market

The global erythropoietin biosimilars market has been expanding rapidly in the past decade. This acceleration has primarily been the result of patent expiries of major erythropoietin biologics in the European market coupled with a demand for cheaper erythropoietin agents in the Asia-Pacific, South American, Middle Eastern, and African markets. BCC Research projects that over the next five years, the global market for erythropoietin biosimilars will continue to enjoy healthy gains while the global market for erythropoietin biologics (i.e., patented products) will shrink substantially.

Erythropoietin is a glycoprotein hormone that stimulates stem cells of the bone marrow for the production of red blood cells. Its other therapeutic functions include initiating the synthesis of hemoglobin and stimulating wound healing, as well as playing a vital role in the brain’s response to neuronal injury. Erythropoietin, which is made naturally in the human body (i.e., biologic), can also be made synthetically (i.e., biosimilar). When discussing the market, these distinctions are important.

Erythropoietin biosimilars may be sold after a branded erythropoietin biologic product loses its patent protection. The biosimilar is cheaper than its branded predecessor, thus changing the market dynamics. Biosimilars perform similarly to the previously patented biologic. They differ from generic drugs in that they are not direct copies of the innovator product, but instead replicate the biologic product’s active properties. Nonetheless, both biosimilars and generics are crucial components to providing affordable healthcare against the backdrop of rising prices of patented and licensed medications.

According to an analysis by BCC Research, the global erythropoietin drug market (biologics and biosimilars) is expected to reach nearly $7.3 billion in 2020, reflecting a five-year compound annual growth rate (CAGR) of 0.2%. By category, erythropoietin biologics (i.e., branded products) are projected to account for 72.9% of the total market in 2020; erythropoietin biosimilars are projected to account for the remaining 27.1% of the market.

More specifically, the erythropoietin biologics segment is expected to decline at a five-year (2015–2020) CAGR of −4.1% to $5.3 billion in 2020. The anticipated decline stems chiefly from the 2015 patent expiry of EPOGEN (epoetin alfa) in the United States and the 2016 patent expiry of Aranesp (darbepoetin alfa) in Europe.

The erythropoietin biosimilars segment is expected to grow at a five-year CAGR of 23.2% to reach $2 billion in 2020. The anticipated entry of biosimilars in the US market and an increasing demand for erythropoietin biosimilars, particularly in developing countries such as India and China, will drive this growth. The demand for erythropoietin biosimilars is also expected to increase in the United States and Europe.

“The entry of erythropoietin biosimilars in Europe and the United States will create a huge impact during the forecast period, resulting in a decline in the global erythropoietin drug market,” says BCC Research analyst Aneesh Kumar. “This decline is due to both the expiry of major patented drugs and the entry of many biosimilar erythropoietin drugs in the European market, which are approximately 20% to 30% cheaper compared to patented drugs.”

The Asia-Pacific region is predicted to account for one-third of the global erythropoietin biosimilars market by 2020. In the Asia-Pacific, biosimilars are preferred over biologics because they cost 70% to 80% less compared to biologics in this region. In Japan, which is the major market for erythropoietin biologics in the Asia-Pacific region, biosimilars are gaining traction; for this reason, the market for biologics is expected to decline further over the next five years.

KIDNEY DISEASE IS DOMINANT APPLICATION FOR ERYTHROPOIETIN AGENTS

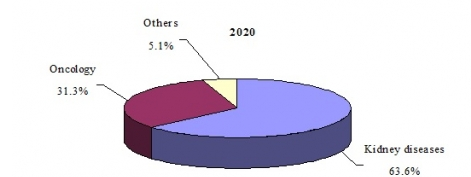

The global erythropoietin biosimilar market for kidney diseases is expected to grow at a five year CAGR (2015–2020) of 23.8% to reach nearly $1.3 billion in 2020. The increasing incidence of chronic kidney disease in both developed and developing regions, plus anticipated approvals of biosimilars such as Hospira’s Retacrit in the United States, are expected to increase sales of biosimilars during the forecast period.

GLOBAL MARKET SHARE FOR ERYTHROPOIETIN BIOSIMILAR DRUGS BY APPLICATION, 2020

Last month, CCM Duopharma Biotech (CCMDB) and PanGen Biotech announced the successful completion of a three-year, joint Phase III clinical trial for a biosimilar erythropoietin in South Korea and Malaysia. The product, called PDA10, can be used in kidney dialysis. PDA10 is expected to be launched in the Malaysian market upon receiving marketing authorization from the National Pharmaceutical Regulatory Agency.

The joint clinical trial was conducted at multiple centers in a total of 298 subjects, of whom 228 (76.5%) were from Malaysia and 70 (23.5%) were from South Korea. The clinical trial was completed in January 2017. Excellent results in terms of equivalence to the pharmacokinetics, pharmacodynamics, and toxicity of the reference product were reported. “The result of the clinical trial demonstrated that PDA10 has similar efficacy [to] the reference product and is biosimilar to the reference product,” said CCMDB. [The Star, 2/15/17]

BCC Research’s study, Erythropoietin-Stimulating Agents: Therapeutic Applications and Global Markets, examines this market in value terms broken down by major types of erythropoietin, by key regions, and by applications. In addition to identifying growth drivers and opportunities, the report provides revenue projections through 2020.

In today’s fast-paced biomedical world, researchers and pharmaceutical companies...

Radiopharmaceuticals represent a cutting-edge frontier in modern medicine, offer...

Implantable Remote Patient Monitoring (IRPM) devices are revolutionizing healthc...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.