Dec 13, 2015

Although hit hard by the recent economic recession, the plastics industry remains one of the global economy's largest and fastest-growing industrial sectors. According to BCC Research, the U.S. plastics industry accounted for more than 900,000 jobs and $380 billion in shipments during 2010. Throw suppliers into the bargain, and that number soars to 1.4 million jobs, and total shipments grow to $417 billion.

Today’s global plastics market is being impacted by dramatic changes in the availability of key feedstocks. The shale gas boom in North America is driving a resurgence of the U.S. plastics industry. Meanwhile, China and other emerging economies are leveraging coal-based olefin production to strengthen their market positions. In addition, an increasingly stringent environmental regulatory landscape, particularly in the construction and energy sectors, are shaping every aspect of the plastics industry.

Continuing improvements in the economy, advances in shale gas technologies, environmental concerns and regulatory measures, as well as cost reduction,s will shape growth in this market for the foreseeable future.

The plastic compounding of raw resins is a large part of this market, and a critical step in the commercial production of plastic products for the automotive, consumer electronics, and appliance industries. Indeed, compounding improves the quality and performance of resins and can lead to the development of higher performing substances. The process also involves a wide array of operations that often involve many different types of equipment or machinery.

“The compounding process, along with improving resin performance, often results in lower costs in addition to the previously noted improved processability and more aesthetically pleasing products,” says BCC Research plastics analyst Charles Forman. "Compounding can improve property profiles of lower-cost commodity resins to such an extent that the resins of higher cost and/or need for higher performance engineering can be reduced or eliminated in many instances.”

Continued R&D spending, a steadily improving economy, and rising demand for the development of environmentally safe resins will drive growth in this market over the next five years.

Source: BCC Research, "The Plastics Compounding Market," November, 2015

THERMOPLASTIC RESINS

The importance of compounding in the plastics industry cannot be overstated. According to BCC Research’s The Plastics Compounding Market (PLS018E), the North American market for compounded thermoplastic resins reached 87.33 billion pounds in 2014 and is expected to grow to 88.78 billion pounds in 2015. BCC Research projects the market to grow to 100.2 billion pounds in 2020, and register a five-year compound annual growth rate of 2.4% from 2015 to 20120.

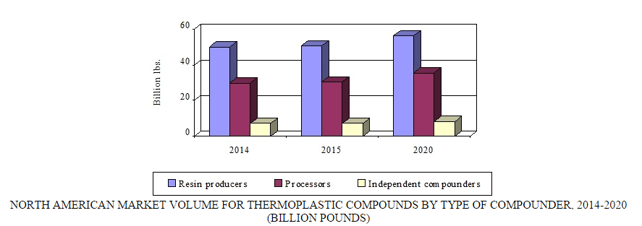

Companies in this industry are usually grouped either as resin producers, plastics processors, and independent compounders. The production of compounded plastics is a highly competitive business based on many factors, including speed, delivery, service, performance, product innovation, product recognition, quality, and price.

The role of each group varies by product segment, with large-volume processors such as extruders of sheet, film and pipe, and profiles assuming a more important compounding role than batch-focused processors like injection molders. Over the years the compounding growth rate for resin producers has generally been slower than that of processors and compounders, as these latter companies take a bigger role in markets where significant proprietary technology is involved.

Compounding trends are also highly dependent on different economic scenarios; for example, when polyethylene prices are high, PE bag makers and other large processors often compensate by increasing the addition of (that is, compounding with) cheaper calcium carbonate filler.

Compounding by processors should grow faster than that by producers or independent compounders; calcium carbonate will remain the dominant thermoplastics filler with about 70% of the filler market by volume; and carbon fiber reinforcement demand will continue to grow at double-digit rates, led by industrial (including automotive) applications.

“The overall mix should change only slightly in the next five years, but there may be swings within specific groups,” says Forman. “The trend for resin producers to compound internally should remain relatively stable and with lower growth than processors or independents. The trend for processors to compound fillers should continue, as prices remain stable and relatively high for major polyolefins.”

The independent compounding group includes several types, including proprietary, custom, toll and concentrate compounders. Independent compounders should assume a more technical role as markets evolve and importers begin playing a larger role in the polyolefins and other commodity markets.

Research and development spending, growing consumer spending resulting from an improving economy, and rising demand for the development of environmentally safe resins will drive growth in this market over the next five years.

Biophotonics: Technologies and Global Markets (PHO024B)

Global Trade: A Strategic Shift The global trade environment is undergoing a dra...

The global demand for cutting-edge materials continues to rise, and at the foref...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.