Oct 4, 2016

Blog Life Sciences As Thrombin Inhibitors Increase, So Too Does Need for Reversal Agents

An aging global population and the increasing worldwide prevalence of cardiovascular disease have created new opportunities for antithrombotic/anticoagulant drugs. BCC Research has revealed in a new study that a variety of novel antithrombotic/anticoagulant products offer better pharmacological and clinical profiles than traditional therapies.

“The healthcare industry continues to advance its understanding of the molecular mechanisms of blood clotting, recombinant DNA technology, and antithrombotic proteins,” says BCC Research analyst Anuj Pathak. “This has spurred development of novel anticoagulants that offer more specific activity on the coagulation cascade, predictable pharmacodynamics and pharmacokinetics, simpler dosing regimens, and few or no laboratory monitoring requirements.”

Antithrombotic drugs comprise two classes: anticoagulants and antiplatelet drugs. Anticoagulants slow clotting, thereby reducing fibrin formation and preventing clots from forming and growing. They are widely used as blood thinners in patients who suffer from heart attacks and other heart-related diseases. Antiplatelet agents prevent platelets from clumping and also prevent clots from forming and growing. The global market is segmented into anticoagulants, antiplatelet agents, and thrombin inhibitors. The latter category, thrombin inhibitors, consists of anticoagulants that inhibit the enzyme thrombin.

There is, however, still an urgent need for an agent that would reverse the antithrombotic effects. The lack of a reversal agent has been a barrier to acceptance of the novel oral anticoagulants (NOACs), which are heavily marketed as a patient-friendly substitute for warfarin. If the effect of warfarin is too high, it will cause excess bleeding. In such cases, Vitamin K is used to reverse serious bleeding effects of warfarin.

In the last few years, the FDA has approved several NOACs including Pradaxa (dabigatran), Xarelto (rivaroxaban), Eliquis (apixaban), and Savaysa (edoxaban). Like warfarin, these are blood thinners, but they also cause bleeding. Pradaxa was the first NOAC approved by the FDA, and it is the only one that is a direct thrombin inhibitor. A reversal agent for Pradaxa, idarucizumab (Praxbind), received US marketing approval in October 2015.

The approval of Praxbind as an antidote for Pradaxa added to the sense of urgency about the need for an agent to reverse the anticoagulant effect of the oral Factor Xa inhibitors—Xarelto, Eliquis, and Savaysa—as well as the intravenous anticoagulant enoxaparin (Lovenox). Factor Xa inhibitors are associated with a reduced risk of intracranial hemorrhage (ICH) compared with warfarin; however, the consequences of the two treatments are similar and can be fatal. In large randomized trials, the 30-day mortality rate in patients with ICH taking a Factor Xa inhibitor exceeded 40%.

WANTED: AN ANTIDOTE FOR FACTOR Xa ANTICOAGULANTS

In August, the FDA declined to approve such an agent, saying that it wants more evidence first. The agency sent Portola Pharmaceuticals a complete response letter (CRL) regarding andexanet alfa, citing manufacturing concerns and directing the company to provide additional information in order to include indications for both Savaysa and Lovenox on its label.

Researchers have reported that this novel reversal agent, designed for all of the newer oral Factor Xa–targeted anticoagulants, did what it was supposed to. The ANNEXA-4 study was designed to evaluate andexanet alfa in patients who present with an acute major bleed while receiving apixaban (Eliquis), rivaroxaban (Xarelto), edoxaban (Savaysa), or enoxaparin (Lovenox). After receiving a bolus of andexanet alfa (a recombinant modified human Factor Xa decoy protein), anti-Factor Xa activity decreased by 89% in patients taking rivaroxaban and by 93% in patients using apixaban. (The anticoagulant mechanism of these drugs is binding to, i.e., blocking, Factor Xa.) These results were reported in The New England Journal of Medicine.

ANNEXA-4 included safety data from 67 evaluable patients, but none of them were receiving edoxaban; four of the 67 received enoxaparin. Most of the patients had advanced cardiovascular disease, and most bleeding events were gastrointestinal (49%) or intracranial (42%). On average, the andexanet bolus was administered less than five hours after NOAC dosing. Andexanet alfa rapidly and substantially reversed anti-Factor Xa activity, and sustained this reversal when followed by a two-hour infusion. In addition, 79% of these patients achieved excellent or good hemostasis over a 12-hour period after infusion.

Portola Pharmaceuticals plans to meet with the FDA as soon as possible to resolve the outstanding questions in the CRL and to determine appropriate next steps.

THROMBIN INHIBITORS ARE FASTEST-GROWING MARKET SEGMENT

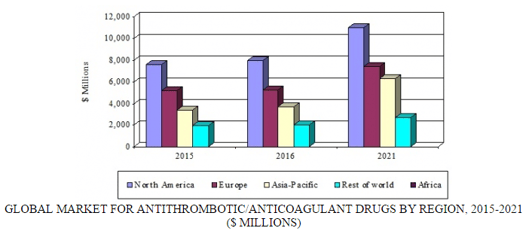

The global market for antithrombotic/anticoagulant drugs should reach $18.9 billion and $27.3 billion by 2016 and 2021, respectively, reflecting a five-year compound annual growth rate (CAGR) of 7.6%. The market is divided into four regions: North America, Europe, Asia-Pacific, and rest of world. The North American market is expected to grow from nearly $8 billion in 2016 to almost $11 billion by 2021, demonstrating a five-year CAGR of 6.6%. In the Asia-Pacific region, the market should total $3.7 billion and approximately $6.3 billion by 2016 and 2021, respectively, growing at a five-year CAGR of 11.2%.

GLOBAL MARKET FOR ANTITHROMBOTIC/ANTICOAGULANT DRUGS BY REGION, 2015-2021

The growth of thrombin inhibitors is key to market expansion. This segment—bolstered by Xarelto, Eliquis, and Savaysa—should grow at the fastest CAGR (12.4%). Traditional anticoagulants and antiplatelet drugs have witnessed a significant drop in market share due to a decline in the development of new drugs, expiration of patents, and availability of alternatives such as the thrombin inhibitors and low-priced generics. Recent innovations and the emergence of novel thrombin inhibitors have also led to the decline of traditional anticoagulants such as heparin and Vitamin K antagonists. Low-molecular-weight heparins such as Lovenox, Fragmin (dalteparin), and warfarin have lost significant market share.

Antithrombotic/Anticoagulant Drugs: Technologies and Global Markets analyzes the market size of anticoagulants by revenue at manufacturers’ sales levels, including low-molecular-weight heparins and oral anticoagulants, as well as breakdowns of antiplatelet drugs and thrombin inhibitors. Global market drivers and trends, with data from 2015, estimates for 2016, and projections of CAGRs through 2021, are provided.

In today’s fast-paced biomedical world, researchers and pharmaceutical companies...

Radiopharmaceuticals represent a cutting-edge frontier in modern medicine, offer...

Implantable Remote Patient Monitoring (IRPM) devices are revolutionizing healthc...

We are your trusted research partner, providing actionable insights and custom consulting across life sciences, advanced materials, and technology. Allow BCC Research to nurture your smartest business decisions today, tomorrow, and beyond.

Contact UsBCC Research provides objective, unbiased measurement and assessment of market opportunities with detailed market research reports. Our experienced industry analysts assess growth opportunities, market sizing, technologies, applications, supply chains and companies with the singular goal of helping you make informed business decisions, free of noise and hype.